CalSTRS earns 6.3% net return in fiscal year 2022–23

News release | Thomas Lawrence

WEST SACRAMENTO, Calif. (July 27, 2023) – The California State Teachers’ Retirement System (CalSTRS) today announced a 6.3% net return on investments for the 2022–23 fiscal year, ending with the total fund value at $315.6 billion as of June 30, 2023.

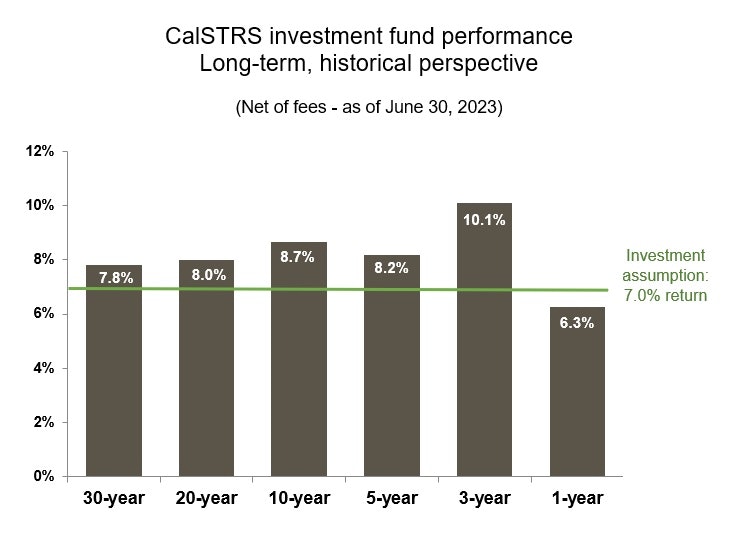

The 2022–23 return keeps CalSTRS on track long term, as the 3-, 5-,10-, 20- and 30-year returns, including the 10.1% 3-year return, all surpass the actuarial assumption of 7.0% despite inflation, rising interest rates and global sociopolitical uncertainty.

Per industry standards, the valuations and benchmark returns of the private assets—primarily held within Real Estate, Private Equity and Inflation Sensitive, which account for more than 30% of the CalSTRS Investment Portfolio—lag three months. CalSTRS’ public assets are valued through June 30, 2023, while private assets are valued through March 31, 2023.

“Our highly diversified portfolio has helped weather the past few years of uncertainty,” said Chief Executive Officer Cassandra Lichnock, “and our multiyear returns, including this improvement from the previous fiscal year, demonstrate that we remain on track to achieve full funding.”

Due in part to 2020–21’s record-breaking 27.2% return, CalSTRS remains in a position to be fully funded by 2046. CalSTRS’ latest funded status is 74.4% as of June 30, 2022.

The next actuarial valuation of the Defined Benefit Program, which will include an updated funded status, will be released in May 2024.

CalSTRS slightly underperformed its total fund benchmark in 2022–23 by three basis points (equivalent to 0.03%), but outperformed its benchmarks in multiple asset classes. Benchmarks are set by the Teachers’ Retirement Board, which governs CalSTRS. Asset classes and the total fund are measured against the benchmarks. Comparing CalSTRS’ performance to its respective benchmarks identifies the contribution or loss caused by manager performance and strategic asset allocation decisions.

CalSTRS fiscal year 2022–23 returns (net of fees)

CalSTRS asset class/ strategy | 10-year % return | 5-year % return | 3-year % return | Fiscal year 2022–23 portfolio % return | Fiscal year 2022–23 custom benchmark % return | Fiscal year 2022–23 over/under performance (%) |

|---|---|---|---|---|---|---|

Public Equity (1) | 9.4 | 8 | 11.3 | 16.7 | 16.3 | 0.4 |

Fixed Income | 2.1 | 1.3 | -3.2 | 0.1 | -0.5 | 0.6 |

Real Estate (1,2) | 10 | 9.2 | 10.5 | -0.5 | -3.9 | 3.4 |

Private Equity (1,2) | 13.9 | 15.5 | 23.1 | -0.9 | 0 | -0.9 |

Risk Mitigating Strategies | 2.7 | 5.3 | 3.5 | -4.3 | -1.8 | -2.5 |

Inflation Sensitive (2) | 7 | 8.6 | 12.1 | 1.5 | 0.8 | 0.7 |

Innovative Strategies (1,2) | 5.9 | 7.9 | 11.3 | 9.3 | 3.4 | 5.9 |

Total fund performance | 8.7 | 8.2 | 10.1 | 6.3 | 6.3 | 0 |

(1) Includes Sustainable Investment and Stewardship Strategies public and private investments.

(2) Asset valuations are as of March 31, 2023, and adjusted for cash flows through June 30, 2023.

As of June 30, 2023, the CalSTRS Investment Portfolio holdings were 40.4% in U.S. and non-U.S. stocks (Public Equity); 16.1% in Real Estate; 10.1% in Fixed Income; 8.8% in Risk Mitigating Strategies; 15.5% in Private Equity; 6.1% in Inflation Sensitive; 1.6% in Strategic Overlay and Cash, and 1.4% in Innovative Strategies.

“Our investment team once again was persistent and innovative and showed a tireless work ethic in safeguarding our members’ retirement money,” said Chief Investment Officer Christopher J. Ailman. “During an unusual and challenging year where the Federal Reserve constantly raised interest rates, our team deftly managed our portfolio to navigate risks such as tightening credit markets and lending standards, lower levels of liquidity and a potential recession.”

Media contact

Thomas Lawrence

Phone: 916-414-1440

M-F, 8 a.m. - 5 p.m. PDT

Newsroom@CalSTRS.com

About CalSTRS

CalSTRS provides a secure retirement to more than 1 million members and beneficiaries whose CalSTRS-covered service is not eligible for Social Security participation. On average, members who retired in 2021–22 had 25 years of service and a monthly benefit of $4,809. Established in 1913, CalSTRS is the largest educator-only pension fund in the world with $315.6 billion in assets under management as of June 30, 2023. CalSTRS demonstrates its strong commitment to long-term corporate sustainability principles in its annual Sustainability Report.