CalSTRS earns 8.4% net return, exceeds benchmark in fiscal year 2023–24

News release | Barbara Zumwalt

WEST SACRAMENTO, Calif. (July 30, 2024) — The California State Teachers’ Retirement System (CalSTRS) today announced an 8.4% net return on investments for the 2023–24 fiscal year, ending with the total fund value at $341.4 billion as of June 30, 2024.

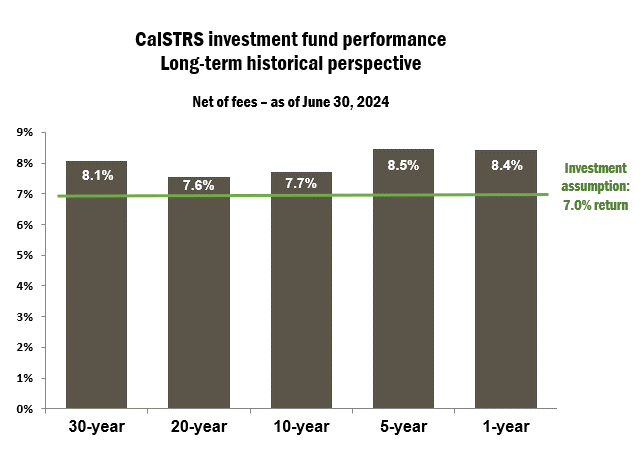

CalSTRS is a long-term investor with a goal of achieving an average return of 7.0% to meet pension obligations. The 2023–24 return keeps CalSTRS on track, as the 5-, 10-, 20- and 30-year returns all surpass the actuarial assumption of 7.0% during a period of inflation, rising interest rates and geopolitical uncertainty.

CalSTRS’ public assets are valued through June 30, 2024, while private assets are cashflow adjusted and valued through March 31, 2024. The valuations and benchmark returns of the private assets, primarily held within the Real Estate, Private Equity and Inflation Sensitive portfolios accounting for over 35% of the CalSTRS Investment Portfolio, lagged three months, per industry standards.

“This is another important step in protecting the more than 1 million California public educators and beneficiaries who rely on us to help secure their future,” Chief Executive Officer Cassandra Lichnock said. “Our strong returns this year reflect our steady progress toward achieving full funding to keep the promises made to our members.”

CalSTRS is ahead of schedule in reaching full funding by 2046. The CalSTRS funded status was 75.9% as of June 30, 2023, the sixth consecutive year the funded status has increased. It has grown more than 13% (from 62.6% to 75.9%) since 2017. Funded status refers to the ratio of CalSTRS assets to its total liabilities.

The next actuarial valuation of the Defined Benefit Program, which will include an updated funded status, will be released in May 2025.

“A year of strong performance in the global public markets underscores the importance of our highly diversified portfolio,” Chief Investment Officer Scott Chan said. “As long-term investors, we prioritize sustained returns over decades. Our track record of consistent returns, above our 7.0% investment assumption, demonstrates our effective approach to investing.

“While the 8.4% return over the past year is commendable, our true commitment lies in fostering consistent, long-term growth for our members’ pensions.”

Public Equity investments showed the strongest returns, at 19%. Also strong was Collaborative Strategies, with a portfolio return of 14.4%.

Private Equity (8.6%), Inflation Sensitive (6.4%), Fixed Income (3.2%) and Risk Mitigating Strategies (2.6%) also delivered positive returns. Real Estate reported a negative return (–9.8%), yet still exceeded its benchmark.

CalSTRS also exceeded its total fund benchmark in 2023–24 by 1.0%. Benchmarks are set by the Teachers’ Retirement Board, which governs CalSTRS. Asset classes and the CalSTRS Investment Portfolio are measured against the benchmarks. Comparing the CalSTRS performance to its respective benchmarks identifies the contribution or loss caused by manager performance and strategic asset allocation decisions.

CalSTRS asset class/strategy | 10-year % return | 5-year % return | Fiscal year 2023–24 portfolio % return | Fiscal year 2023–24 custom benchmark % return | Fiscal year 2023–24 over/under performance (%) |

|---|---|---|---|---|---|

Public Equity (1) | 8.9 | 10.7 | 19.0 | 18.6 | 0.4 |

Fixed Income | 1.9 | 0.4 | 3.2 | 3.0 | 0.2 |

Real Estate (1,2,3) | 7.5 | 5.1 | –9.8 | –12.0 | 2.2 |

Private Equity (1,2) | 12.8 | 15.1 | 8.6 | 6.6 | 2.0 |

Risk Mitigating Strategies | 2.8 | 4.1 | 2.6 | 1.8 | 0.8 |

Inflation Sensitive (2) | 6.6 | 8.7 | 6.4 | 5.2 | 1.2 |

Collaborative Strategies (1,2) | 7.4 | 8.9 | 14.4 | 8.8 | 5.6 |

Total fund performance | 7.7 | 8.5 | 8.4 | 7.4 | 1.0 |

(1) Includes Sustainable Investment and Stewardship Strategies public and private investments.

(2) Asset valuations are as of March 31, 2024, and adjusted for cash flows through June 30, 2024.

(3) Real Estate returns include a historical revision for an investment expense misclassified from January 2020 until June 2023 (23 and 12 basis point reductions for 5- and 10-year, respectively).

As of June 30, 2024, the CalSTRS Investment Portfolio holdings were 41.4% in U.S. and non-U.S. stocks (Public Equity); 15.5% in Private Equity; 13.9% in Real Estate; 11.2% in Fixed Income; 8.4% in Risk Mitigating Strategies; 6.3% in Inflation Sensitive; 1.7% in Strategic Overlay and Cash, and 1.6% in Collaborative Strategies.

Media contact

Barbara Zumwalt

Phone: 916-414-1440

M-F, 8 a.m. - 5 p.m. PDT

Newsroom@CalSTRS.com

About CalSTRS

CalSTRS provides a secure retirement to more than 1 million members and beneficiaries whose CalSTRS-covered service is not eligible for Social Security participation. On average, members who retired in 2022–23 had 25 years of service and a monthly benefit of $5,141. Established in 1913, CalSTRS is the largest educator-only pension fund in the world with $341.4 billion in assets under management as of June 30, 2024. CalSTRS demonstrates its strong commitment to long-term corporate sustainability principles in its annual Sustainability Report.