Required disclosure filings

CalSTRS disclosure forms 600-H & 600-J

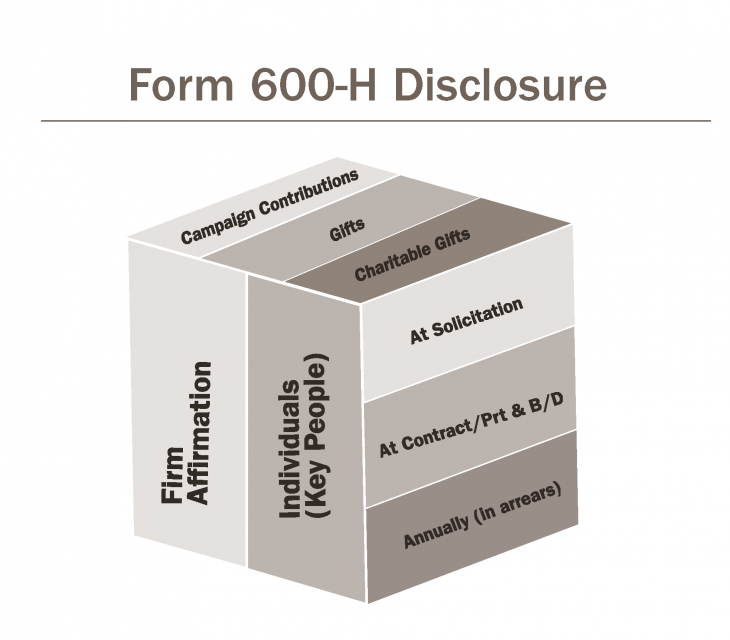

Disclosure Form 600-H Campaign and Gift disclosure is required to provide CalSTRS with information about the parties we do business with and who provide us with services, except for subscriptions.

The illustration shows the primary components of the Form 600-H disclosure. Disclosure Form 600-J regarding Placement Agents is required to provide CalSTRS with information about the marketers serving as lobbyist placement agents.

Restrictions

CalSTRS Policy on Disclosure of Contributions and Gifts (Teachers’ Retirement Board Policy Manual, §600-H) sets forth restrictions on campaign contributions, charitable contributions and gifts made to CalSTRS officers or employees, or CalSTRS board members (or candidates for board member, Controller, Treasurer or Superintendent of Public Instruction) by entities engaging in business with CalSTRS for gain. Additionally, if you are interested in doing business with CalSTRS, your firm is subject to restrictions on campaign contributions set forth in the California Code of Regulations 5 C.C.R. §24010-24013). Subscriptions are exempt.

Teachers’ Retirement Board Policy Manual, §600-HCalifornia Code of Regulations (5 C.C.R. §24010-24013)What information must be filed

Entities/firms and their key personnel are required to report the following:

- Campaign Contributions in excess of $250. If the business is an investment relationship, disclosure of campaign contributions made to the Governor or candidates for governorship must also be made

- Charitable Contributions in excess of $250, charities that were directed by staff to you

- Gifts (including meals, entertainment and tangible items) greater than $50

Who must file

In order to ensure compliance with the above policy and regulations, Form 600-H – Disclosure of Contributions and Gifts is required from all soliciting and existing contracting firms/entities

- On behalf of the entity/firm; please be sure to check the box in the top left-hand corner of the form, AND this requirement is needed to affirm that the Campaign Contribution aggregate amounts are not exceeded

- For each of the Key Personnel identified

Filing stages

There are three stages at which CalSTRS Key Personnel and the entity/firm/broker-dealer are required to report contributions and gifts given to Key Personnel, including but not limited to the following:

Solicitation

(Typically at due diligence phase – firm is new to CalSTRS or presents a newly proposed investment opportunity)

- Please complete and return the Form 600-H – Disclosure of Contributions and Gifts (Solicitation - checked) within 15 business days of receiving an official email from CalSTRS staff.

- Please note these forms will only be reviewed if your entity/firm has interacted or met with CalSTRS staff and an official email was sent to you requesting this submission.

Contract, partnership, broker/dealer “approval” phase

- State Contracting Process: If your firm is entering into a formal Contract, Alternative Solicitation Contract, or a Solicitation to Contract with CalSTRS, the Procurement office will work directly with you to obtain these required forms. Subscriptions are excluded.

- Partnerships/Joint Ventures etc.: If you are entering into a new Investment opportunity/commitment with CalSTRS and it has been 30 days or more since you submitted your Annual or Solicitation filing, you are required to file updated forms. Otherwise, you may provide CalSTRS with an email confirming that you have no changes to your disclosure reporting.

- Broker/Dealer Services: If your entity/firm provides only broker/dealer services to CalSTRS, you are required to file at Contract – (checked) and annually thereafter.

Annually thereafter (for the prior calendar year) due April 1

CalSTRS staff will send you an email request, typically in February or early March, requesting that you file on behalf of your entity/ firm and for each of the key individuals identified for the prior calendar year.

We have incorporated the three filing stages on a single form. At the bottom of the Form 600-H, highlighted in the red box are the three phases above, please select the most appropriate phase.

Since 2011, California law has required all placement agents and many internal marketing employees to register as lobbyists. Please refer to the Fair Political Practices Commission and Secretary of State websites for additional information.

Additionally, CalSTRS has a policy regarding the Disclosure of Placement Agents and Payments (Teachers’ Retirement Board Policy Manual, §600-J), which requires firms/entities to file a Form 600-J – Disclosure of Placement Agent Relationships prior to entering into any investment transaction or investment management contract with CalSTRS.

Teachers’ Retirement Board Policy Manual, §600-JThis form is to be completed for the following:

- Prospective Investments

- New Investments

- Amendment to an existing Investment

- Placement Agent (PA) Termination

- Within 30 days of any changes filed

This disclosure of placement agent relationships includes any internal marketing staff or third party that assisted with the solicitation or the retention of CalSTRS as a client and any fees payable to the placement agent as a result of the relationship. Fees payable, for purposes for this request, include, but are not limited to:

- Placement agent fees

- Solicitation fees

- Referral fees

- Promotion fees

- Introduction to matchmaker fees

- Internal marketing incentives

If a Placement Agent (internal/external) party is participating or will be involved in this investment opportunity, you must complete the entire Form 600-J – Disclosure of Placement Agent Relationships form. If your firm is not using a Placement Agent for this Investment Opportunity, the Investment Office requires that your entity/firm complete only the first page, which should be returned to CalSTRS. If you are entering into a contract through the CalSTRS Procurement process, they require the entire form.

If your firm discloses Placement Agent external fees paid, your entity/firm will be required to provide updated fees, requested quarterly, until completed. In addition, annually a Form 600-H will be required by any identified Placement Agents to disclose any campaign contributions and gifts made during the prior calendar year.

Submission of Form 600-H and Form 600-J

These forms must be submitted via email or mail (email is preferred):

- Email to InvestmentCompliance@CalSTRS.com

- Mail to:

California State Teachers’ Retirement System

Attn: Disclosure Forms, MS-4

100 Waterfront Place, 14th Floor

West Sacramento, CA 95605-2807

Please submit any questions regarding these forms by email to InvestmentCompliance@CalSTRS.com.

For accessible versions of files on this page, contact ADACoordinator@CalSTRS.com.